Cryptocurrency trading has become a sensation, captivating the attention of both novice and seasoned investors. One method that has gained popularity for trading these digital assets is through Contract for Differences (CFDs). If you’re eager to explore the thrilling world of cryptocurrency CFD trading, this guide will walk you through the essentials, benefits, and strategies to get you started.

Understanding Cryptocurrency CFDs

What are CFDs?

Contracts for Differences (CFDs) are financial derivatives that allow you to speculate on the price movement of assets without actually owning them. In the case of cryptocurrency CFDs, traders can predict whether the price of a cryptocurrency will rise or fall and potentially profit from the difference.

CFDs offer a convenient way to trade various cryptocurrencies, such as Bitcoin, Ethereum, and Litecoin. You can go long (buy) if you anticipate a price increase or go short (sell) if you expect a decline. The flexibility to profit from both rising and falling markets makes CFDs an attractive option.

Why Trade Cryptocurrency CFDs?

One major benefit of trading cryptocurrency CFDs is leverage. This means you can open larger positions with a relatively small amount of capital. However, while leverage can magnify gains, it can also amplify losses, so it’s crucial to manage risk effectively.

Another advantage is the ability to trade on margin. This allows you to open trades by depositing a fraction of the total trade value, giving you more exposure to potential gains. Additionally, CFD trading platforms often provide access to advanced tools and features, such as stop-loss orders and charting tools.

How to Get Started with CFD Trading

To start trading cryptocurrency CFDs, first, choose a reputable CFD broker. Ensure the platform is regulated, offers a wide range of cryptocurrencies, and provides user-friendly features. It’s also essential to understand the fees and charges associated with trading.

Next, open an account with your chosen broker and complete the necessary verification steps. Most brokers offer demo accounts, allowing you to practice trading with virtual funds before committing real money. This is a great way to familiarize yourself with the platform and develop your trading strategy.

Key Strategies for Trading Cryptocurrency CFDs

Technical Analysis

Technical analysis involves studying historical price charts and using indicators to predict future price movements. Common tools include moving averages, Relative Strength Index (RSI), and Fibonacci retracements. By analyzing patterns and trends, traders can make informed decisions about when to enter or exit trades.

It’s important to combine multiple indicators to confirm signals and reduce the likelihood of false alarms. For example, if a moving average crossover aligns with an RSI reading indicating overbought conditions, it may signal a potential reversal.

Fundamental Analysis

Fundamental analysis focuses on the intrinsic value of the asset. For cryptocurrencies, this means evaluating factors such as technology, team, market demand, and news events. Staying updated with the latest developments in the cryptocurrency space can provide valuable insights.

For instance, major announcements like regulatory changes, technological upgrades, or partnerships can significantly impact cryptocurrency prices. By understanding the broader context, traders can anticipate market reactions and adjust their positions accordingly.

Risk Management

Effective risk management is crucial for long-term success in CFD trading. Start by setting a risk tolerance level and stick to it. This involves determining the maximum amount you’re willing to lose on a single trade and using tools like stop-loss orders to limit potential losses.

Diversifying your portfolio by trading multiple cryptocurrencies can also reduce risk. Instead of putting all your funds into one asset, spread your investments across different coins to mitigate the impact of adverse price movements.

The Benefits of Trading Cryptocurrency CFDs

Flexibility and Accessibility

One of the key benefits of trading cryptocurrency CFDs is the flexibility it offers. Unlike traditional markets, the cryptocurrency market operates 24/7, allowing traders to take advantage of opportunities at any time. This is particularly beneficial for those with busy schedules, as you can trade whenever it’s convenient for you.

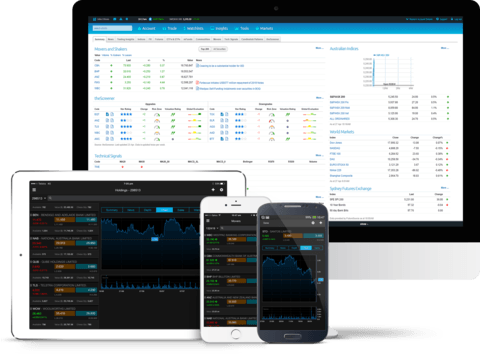

Additionally, CFD trading platforms are accessible from various devices, including computers, smartphones, and tablets. This means you can monitor your trades and make informed decisions on the go, ensuring you never miss an opportunity.

Potential for High Returns

The volatility of the cryptocurrency market presents both risks and opportunities. While prices can fluctuate significantly within short periods, this volatility can lead to substantial profits for savvy traders. By using leverage and margin, you can amplify your potential returns.

However, it’s important to approach trading with caution. Implementing a well-thought-out strategy and sticking to your risk management plan can help you navigate the volatility and maximize your gains.

No Ownership Hassles

Trading cryptocurrency CFDs means you don’t actually own the underlying asset. This eliminates the need for wallets, private keys, and the associated security risks. Instead, your focus is purely on speculating the price movements, simplifying the overall process.

Furthermore, CFD brokers often offer additional features, such as negative balance protection, ensuring you don’t lose more than your initial investment. This added layer of security can provide peace of mind, especially for beginners.

Conclusion

Trading cryptocurrency CFDs offers an exciting opportunity for investors to capitalize on the dynamic world of digital assets. By understanding the fundamentals, leveraging key strategies, and managing risk effectively, you can enhance your trading experience and potentially achieve significant returns.

Ready to start your cryptocurrency CFD trading journey? Sign up with a reputable CFD broker today and explore the endless possibilities. For further resources and expert advice, visit our website and learn more about how we can support your trading endeavors.

Happy trading, and may your investments thrive!